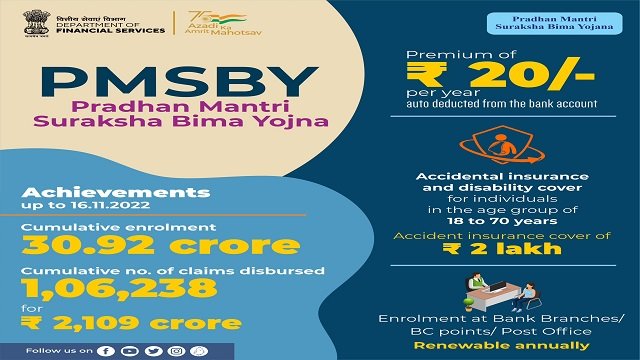

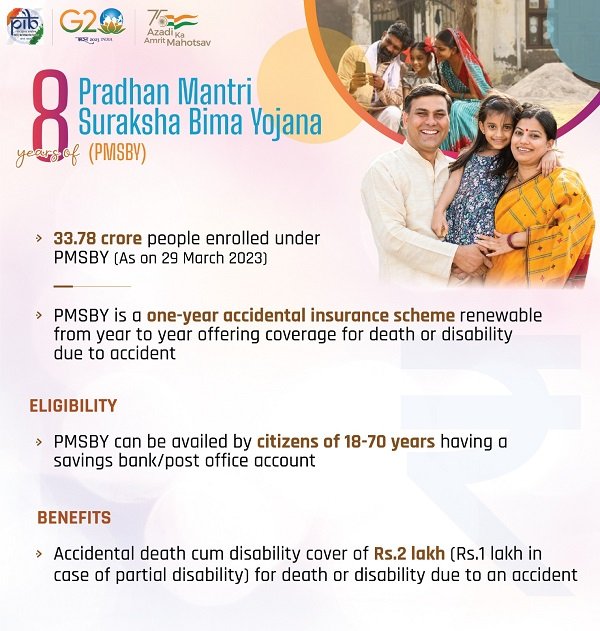

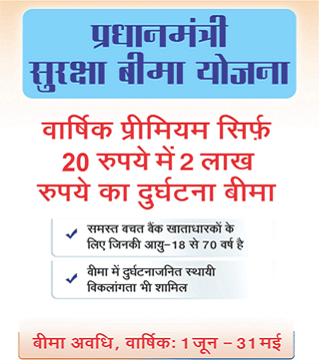

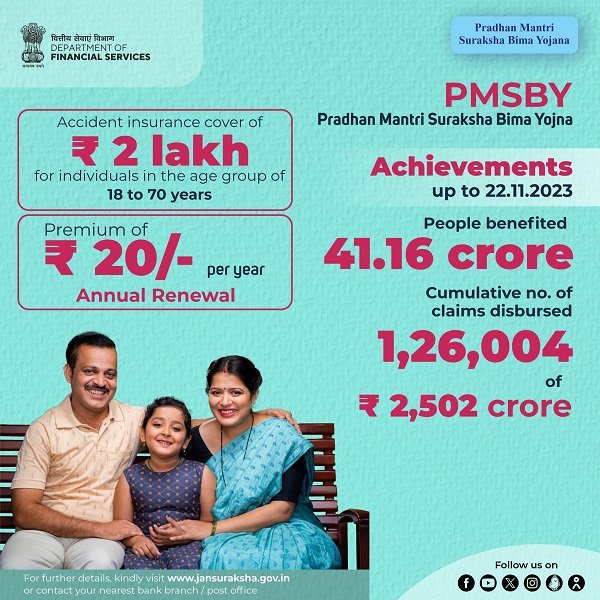

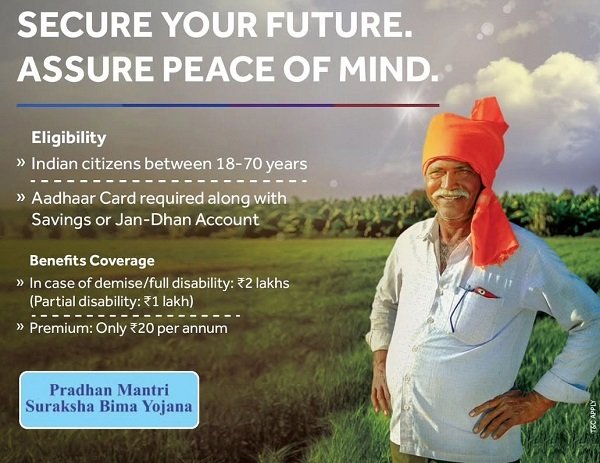

Pradhan Mantri Suraksha Bima Yojana (PMSBY) provides one-year accidental insurance coverage to people in the age group of 18 to 70 years at a yearly premium of Rs. 20 per year. Rs. 2 lakh will be provided in the event of death or permanent disability of an insured person, and Rs. 1 lakh will be provided in the event of partial disability of an insured person.

Read here the complete details about the scheme.

Pradhan Mantri Suraksha Bima Yojana Highlights | |

|---|---|

| Scheme Name | Pradhan Mantri Suraksha Bima Yojana. (PMSBY) |

| Date of Launch | 01-06-2015 |

| Benefits Provided | Personal Accidental Cover. |

| Eligible Beneficiaries | Person in the Age Group of 18 to 70 years. |

| Official Website | Jan-Dhan se Jan Suraksha Portal. |

| Responsible Department | Department of Financial Services. |

| How to Apply |

|

| Read Scheme in Hindi | प्रधानमंत्री सुरक्षा बीमा योजना. |

| Free Scheme Updates | WhatsApp | Telegram |

Introduction of Pradhan Mantri Suraksha Bima Yojana – PMSBY: A Brief Insight

- In the year 2015, the Central Government launched two major welfare schemes for the common people of India.

- The first one is Pradhan Mantri Jeevan Jyoti Bima Yojana, which is a life insurance cover scheme for Indian Citizens.

- And the other one is, about which we are talking today, is “Pradhan Mantri Suraksha Bima Yojana” (प्रधानमंत्री सुरक्षा बीमा योजना).

- It was launched on the 1st of June 2015.

- Department of Financial Services of the Central Government is the implementing department of this scheme.

- PM Suraksha Bima Yojana will be implemented with the help of banks, which are the master policyholders in this scheme and through the Public Sector General Insurance Companies and other General Insurance Companies.

- The main objective of the government behind starting this scheme is to provide accidental insurance cover to the common people of the country.

- Pradhan Mantri Suraksha Bima Yojana provides a 1-year accidental insurance cover in which financial assistance will be provided for the death or disability of an insured person due to an accident.

- The official definition of accident as per guidelines, is “A sudden, unforeseen and involuntary event caused by external, violent and visible means.

- People between the age group of 18 years to 70 years are only eligible for enrollment under Pradhanmantri Suraksha Bima Scheme.

- Financial Assistance of Rs. 2,00,000/- will be provided in case of the death of an insured person in an accident.

- The amount of Assistance will be provided to the nominee or legal heir of the deceased insured person.

- And the same amount of Rs. 2,00,000/- will be provided to the insured person in case of complete disability due to an accident.

- Whereas, Rs. 1,00,000/- will be provided to the insured person under Pradhan Mantri Suraksha Bima Scheme in case of partial disability.

- The policy will cover accidental insurance for a period from the 1st of June to 31st of May every year.

- Applicant will have to pay the premium amount of insurance of Rs. 20/- every year to get himself/ herself covered under PMSBY.

- Visit the bank and enrol yourself under this scheme to avail the benefit of accidental insurance cover at just Rs. 20/- per premium under the PM Insurance Scheme of the Central Government.

- As per official records, more than 51.73 crore people are enrolled under the Pradhan Mantri Suraksha Bima Yojana of the Central Government.

- It is hereby reiterated that the accidental insurance cover will automatically terminate once the insured person turns 70 years old.

- Call on the national toll-free number in case any help or assistance is required regarding the PM Insurance Scheme, alias PM Suraksha Bima Scheme

Benefits Provided to Eligible Beneficiaries

- Central Government will provide the following benefits to all registered/ enrolled people under Pradhan Mantri Suraksha Bima Yojana – PMSBY (pm insurance scheme) :-

- 1 Year Personal Accidental Insurance Cover.

- Financial Assistance in case of Death or Disability of an Insured Person.

- Nominal Yearly Premium of Just Rs. 20/- per year.

- Following financial assistance is payable under PMSBY in case of death or disability of the insured person :-

Condition Insurance Amount Death Rs. 2 Lakh Total and Irrecoverable Loss of Both Eyes or Loss of Use of Both Hands or Feet or Loss of Sight of One Eye and Loss of Use of Hand or Foot Rs. 2 Lakh Total and Irrecoverable Loss of Sight of One Eye or Loss of Use of One Hand or Foot Rs. 1 Lakh

Eligibility Conditions Required to be Fulfilled

- Any Applicant who fulfils the below-mentioned eligibility criteria of Pradhan Mantri Suraksha Bima Yojana (PMSBY) can enrol themselves under this scheme and avail the benefit of personal accident insurance cover :-

- All Indian citizens are Eligible.

- The Age of Application should be between 18 years to 70 years.

- An account in a Bank or a Post Office is needed.

- Premium Amount of Rs. 20/- will be deducted automatically from the account every year.

- JanDhan Bank Account Holders are also Eligible.

Documents Required to be Attached

- Beneficiary Applicant will have to submit the below-mentioned documents at the time of enrollment under Pradhan Mantri Suraksha Bima Yojana :-

- Bank Account Details.

- Aadhaar Card.

- PAN Card.

- Mobile Number and Email.

- Premium Auto-Debit Consent Form.

How Beneficiaries Can Apply to Avail the Benefit of this Scheme

- Pradhan Mantri Suraksha Bima Yojana enrollment/ registration can be done through the following ways :-

- By visiting the Bank.

- Through the Bank’s Official Website.

Offline Application Process

- The applicant will have to visit the bank branch where he has an active bank account.

- Generally, bank offers enrollment under Pradhan Mantri Suraksha Bima Yojana at the time of opening a new savings bank or post office account.

- Take the Application Form/ Enrollment Form of PM Suraksha Bima Yojana from the bank official and fill in the details correctly.

- Attach all the required documents with it.

- It is mandatory to give auto debit permission for the premium of Rs. 20/- at the time of filling the application form.

- Submit the PMSBY Enrollment Form and all the documents to the bank officials.

- Bank Officials will primarily verify the details of the applicant and verify it by putting their seal and signature on it.

- Verified applications of the PM Suraksha Bima Scheme will be forwarded to empanelled insurance companies for further approval.

- Insurance Companies will verify the details from their end and enrol the user under PMSBY.

- Policy Documents will be sent to the registered email address of the applicant.

- Contact Bank Officials if any help or assistance is required regarding enrollment under this scheme.

Online Application Process

- Applicants can also enrol themselves online under the Prime Minister Suraksha Bima Yojana.

- The online facility is provided by the Official Website of Banks/ Financial Institutions.

- Applicant will have to log in to the bank website with their internet banking ID and password.

- Choose Pradhanmantri Suraksha Bima Yojana from the services tab.

- Fill out the online enrollment application form and upload all the required documents.

- Provide the permission to debit the premium amount of Rs. 20/- from the applicant’s bank account automatically.

- Review the filled information and submit the form.

- The bank will review the details and forward them to insurance companies for enrollment.

- Insurance Companies will enrol the eligible applicants under the PM Suraksha Bima Scheme and the policy documents will be sent to the registered email address.

- Claim of Pradhanmantri Suraksha Bima Yojana will also be filed through the bank branch.

Claim Procedure of Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Beneficiary Insured Person will have to claim the insurance amount in case of disability, and the insured person’s nominee/ legal heir will claim the insurance amount in case of the death of the insured person in the accident.

- Claim Process of Pradhan Mantri Suraksha Bima Yojana (PMSBY) will be processed through the bank in which the insured person has an account and through which the premium of the scheme has been paid.

- Visit the bank branch and collect the Claim Application Form of Pradhanmantri Suraksha Bima Yojana.

- Fill the claim application form properly and attach the following documents with it :-

- Identity Proof of Insured Person.

- Death Certificate of Insured Person. (In Case of Death)

- Nominee/ Legal Heir Identity Proof.

- Bank Account Details.

- Insurance Policy Documents.

- Any Documents asked by Bank.

- Disability Certificate. (In case of Disability)

- Submit the PMSBY Claim Application Form along with all the documents to the bank branch.

- Bank Officials will process the claim from their end by verifying it and further forwarding it to the insurance company for the disbursement of the insurance amount.

- Insurance Company will also verify the received claim application form and documents and give its approval after verification.

- Financial Assistance of Rs. 2 lakh in case of death or complete disability and Rs. 1 lakh in case of partial disability will be transferred to the bank account of the claimant.

- The claimant can contact the bank branch if they face any issues regarding the claim process of this scheme.

No Claim Conditions

- Central Government sets some specific conditions in which no claim will be applicable under the Pradhan Mantri Suraksha Bima Yojana. (PMSBY)

- The following are the conditions under which no insurance company is liable to pay any accidental insurance amount to the nominee/ legal heir or to the insured person itself :-

- When the Insured Person turns 70 years old.

- No Insurance Premium Installment paid due to less or insufficient balance in the account.

- Closure of Bank or Post Office Account of Insured Person.

- Enrolling under PM Suraksha Bima or registering under PMSBY through multiple bank accounts of a single person.

Important Application Forms of the Scheme

- In every bank and post office, the Pradhan Mantri Suraksha Bima Yojana (PM Insurance Scheme ) Application Form is available. Beneficiary can also download the sample application form of PM Suraksha Bima Yojana from her,e which is available in multiple Indian Languages :-

Claim Forms of Scheme

- In case of the death of an insured person in an accident or an insured person gets disabled in an accident, then their nominee or legal heir will have to fill out the claim form of PM Suraksha Bima Yojana. Following are the sample Pradhan Mantri Suraksha Bima Yojana (PMSBY) claim form, which is available in multiple Indian languages :-

Important Links Available

- Official Website of Jan-Dhan se Jan Suraksha.

- Guidelines of Pradhan Mantri Suraksha Bima Yojana. (PMSBY)

- FAQs of Pradhan Mantri Suraksha Bima Yojana. (PMSBY)

- State Wise Jan-Suraksha Toll Free Numbers.

- Official Website of Department of Financial Services.

Contact Details in Case of Help Needed

- National Toll Free Number :-

- 1800110001.

- 18001801111.

- Contact Numbers of Department of Financial Services.

- Department of Financial Services,

Ministry of Finance,

Jeevan Deep Building, Sansad Marg,

New Delhi – 110001.

Tabassum is a senior content writer with 5 years of experience in creating well-researched and user-friendly content on Central and State Government schemes.