Beneficiary Street Vendors of the PM SVANidhi Scheme can now apply for a Credit Card with a maximum credit limit of Rs. 30,000/- under the Prime Minister Street Vendor’s Atmanirbhar Nidhi Credit Card Scheme, also known as PM SVANidhi Credit Card Scheme.

Read the complete article for full details.

PM SVANidhi Credit Card Scheme Highlights | |

|---|---|

| Scheme Name | PM SVANidhi Credit Card Scheme. |

| Date of Launch | 22-01-2026. |

| Benefits Provided | Credit Card with a Limit of Rs. 30,000/. |

| Eligible Beneficiaries | Beneficiary Street Vendors. |

| Responsible Agency | Ministry of Housing and Urban Affairs. |

| How to Apply | Through the Official Portal or Mobile App. |

| Read Scheme in Hindi | प्रधानमंत्री स्वनिधि क्रेडिट कार्ड योजना. |

| Free Scheme Alerts | WhatsApp | Telegram |

Introduction of PM SVANidhi Credit Card Scheme: A Brief Insight

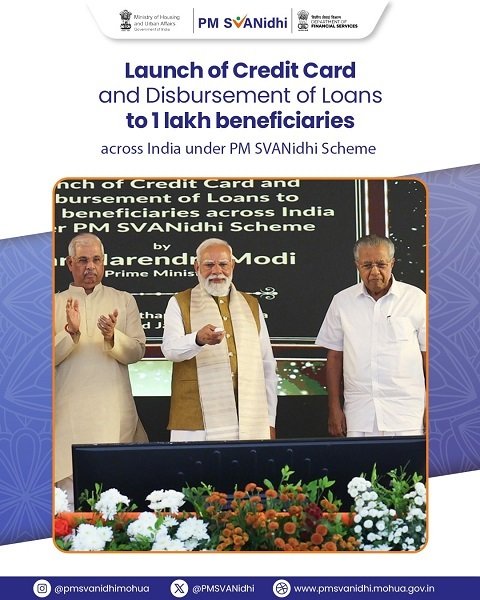

- Honourable Prime Minister Shri Narendra Modi launched the PM SVANidhi Credit Card Scheme (प्रधानमंत्री स्वनिधि क्रेडिट कार्ड योजना) on 23rd January 2026.

- It’s an additional beneficial component of the already operational PM SVANidhi Scheme, which was launched in the year 2020.

- As we already know that PM Street Vendor’s Atmanirbhar Nidhi” alias PM SVANidhi Scheme was started to provide short term credit facility to street vendors for their business.

- Since its launch, 1,10,24,146 loan application is sanctioned by the financial institutions under the PM SVANidhi Scheme of the Central Government.

- Now, with an objective to further empower the Street Vendors, the PM SVANidhi Credit Card Scheme will provide the on demand access to credit.

- A RuPay Retail (Personal) Credit Card will be issued in the name of the Beneficiary Street Vendor with a maximum credit limit of Rs. 30,000/- under PM SVANidhi Credit Card Scheme.

- The initial limit of the credit card will be Rs. 10,000/-, which will be further increased to Rs. 30,000/- as per the fair usage of the card.

- Beneficiary Street Vendor having an age between 21 years to 65 years and who already repaid the 1st and 2nd Tranche of loan availed under PM SVANidhi Scheme is eligible to apply for a credit card under this scheme.

- An issued credit card under this scheme is completely interest-free and the repayment period of the credit is 20 to 50 days.

- Application is open and beneficiary street vendors can apply for a credit card up to a maximum credit limit of Rs. 30,000/- under the PM SVANidhi Credit Card Scheme through the Official Website and the Official Mobile App of the PM SVANidhi Scheme.

- If there is an artisan or craftsperson in the street vendor family, then they can apply for “PM Vishwakarma Yojana” in which toolkit assistance and skill training will be provided.

- Further, the complete list of Central Government Schemes can be seen here.

Benefits Provided to Eligible Beneficiaries

- Beneficiary Street Vendors will receive the following benefits from the Central Government under the PM SVANidhi Credit Card Scheme :-

- A RuPay Personal Credit Card will be issued to the Beneficiary Street Vendor.

- The maximum credit limit of the issued credit card is Rs. 30,000/-.

- The initial limit of the credit card is Rs. 10,000/-, which will further increase to Rs. 30,000/-.

- Credit provided under the PM SVANidhi Credit Card is interest-free.

- The repayment period of credit is 20 to 50 days.

- EMI Facility is also available to repay the credit card amount.

- Validity of PM SVANidhi Credit Card is 5 years from the date of issue.

Eligibility Conditions Required to be Fulfilled

- Credit Card under the PM SVANidhi Credit Card Scheme will be issued to only those beneficiaries who fulfil the below-mentioned eligibility criteria of this scheme :-

- Beneficiary Street Vendors who repaid the 2nd Tranche Loan of the PM SVANidhi Scheme are eligible to apply.

- Beneficiary Street Vendor should be Eligible to apply for the 3rd Tranche Loan of the PM SVANidhi Scheme.

- Street Vendors who have already availed the 3rd Tranche Loan, whether the loan is active or fully repaid, are also eligible to apply for a Credit Card.

- The Age of the Beneficiary Street Vendor should be between 21 and 65 years.

- International and Foreign Exchange Transaction is not allowed.

- An issued credit card cannot be used to withdraw cash through an ATM or any POS Machine.

Documents Required to be Attached

- The documents that are required at the time of applying for a Credit Card under the Central Government’s PM SVANidhi Credit Card Scheme are mentioned below :-

- Aadhaar Card of the Applicant.

- PAN Card.

- Any One Document :-

- Certificate of Vending. (CoV)

- Letter of Recommendation. (LoR)

- Identity Card issued by the Urban Local Body or Block Offices.

- Details of the Saving Bank Account.

- Current Address Proof.

- Mobile Number.

- Email ID.

How Beneficiaries Can Apply to Avail the Benefit of this Scheme

- Eligible Beneficiaries of the PM SVANidhi Scheme can apply for a credit card under the PM SVANidhi Credit Card Scheme through the following ways :-

- Through the Official Portal of the PM SVANidhi Scheme.

- Through the Official Mobile App of the PM SVANidhi Scheme.

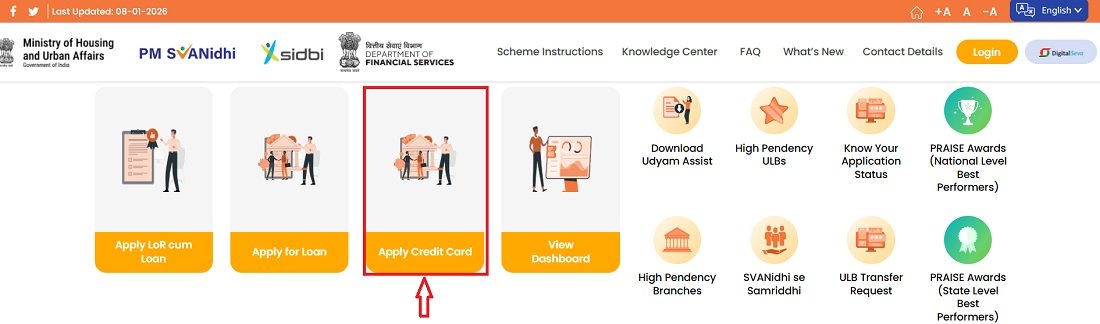

Through the Official Portal of the PM SVANidhi Scheme

- Street Vendors who have already availed and repaid the 2nd Tranche Loan of the PM SVANidhi Scheme can apply for a credit card via Official Portal.

- Visit the PM SVANidhi Scheme Website and Click on “Apply Credit Card”.

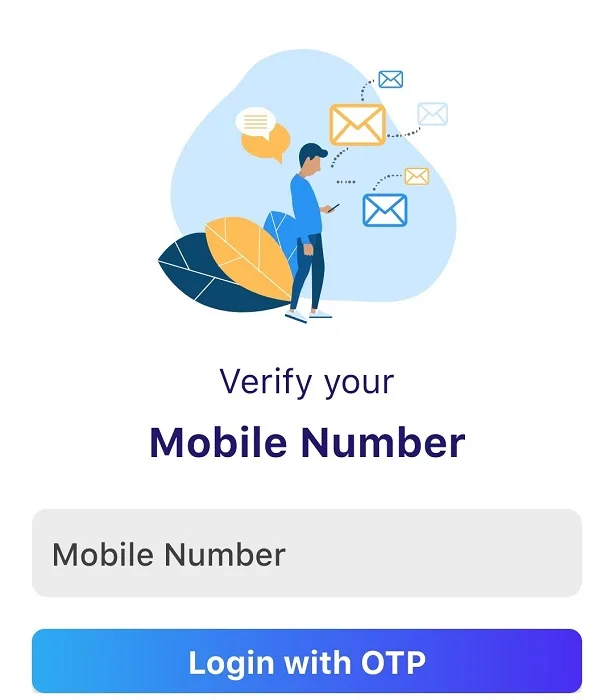

- Login with the help of your registered mobile number, which will be further verified through OTP.

- A Online Application Form of PM SVANidhi Credit Card Scheme will appear on the screen.

- Applicant Street Vendor will have to fill in the details in the application form and upload all the required documents.

- Preview the filled details in the online application form and click on the submit button to submit it.

- The respective officials will verify the received information and make a list of eligible applicants.

- The list of selected street vendors will then be forwarded to the bank and financial institutions to issue credit cards.

- A PM SVANidhi Credit Card will be issued by the bank, which can be collected by the beneficiary by visiting the branch.

- The beneficiary can call on 011 23062850 in case any help or assistance is required regarding the PM SVANidhi Credit Card Scheme.

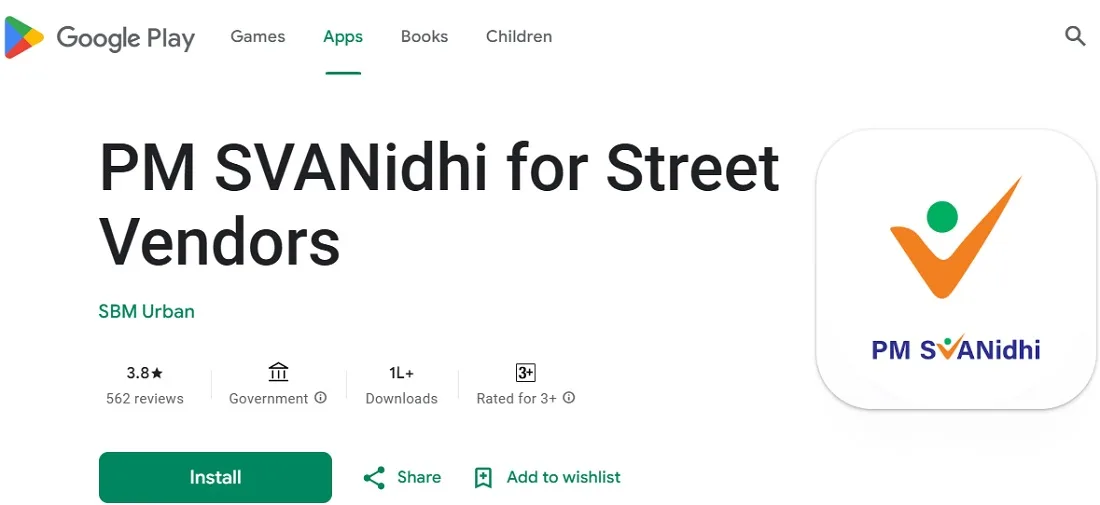

Through the Official Mobile App of the PM SVANidhi Scheme

- Credit Card under the PM SVANidhi Credit Card Scheme can also be applied through the PM SVANidhi Scheme Mobile App.

- Download the Mobile App from the Google Play Store.

- Log in with the help of your registered mobile number and verify it through OTP.

- Click on Apply for Credit Card from the Dashboard.

- Fill in the asked details in the PM SVANidhi Credit Card Scheme Online Application Form.

- Upload all the required documents on the portal.

- Check all the filled information and submit it.

- The submitted application form and documents will be verified by the respective officials and the list of selected beneficiaries will be forwarded to banks for the issuance of a credit card.

- The beneficiary can collect their credit card from the bank branch.

Important Links Available

- PM SVANidhi Credit Card Scheme Online Application.

- PM SVANidhi Credit Card Scheme Official Guidelines.

- PM SVANidhi Scheme Official Mobile Application.

- PM SVANidhi Scheme State Nodal Officer Contact Numbers.

- PM SVANidhi Scheme Official Portal.

Contact Details in Case of Help Needed

- PM SVANidhi Scheme Helpline Numbers :-

- 9321702101.

- 1800111979.

- PM SVANidhi Scheme Grievance Number :- 011 23062850.

- PM SVANidhi Scheme Helpline Email :-

- pmSVANidhi.support@sidbi.in.

- portal.pmSVANidhi@sidbi.in.

- querysvs@cgtmse.in.

Tabassum is a senior content writer with 5 years of experience in creating well-researched and user-friendly content on Central and State Government schemes.